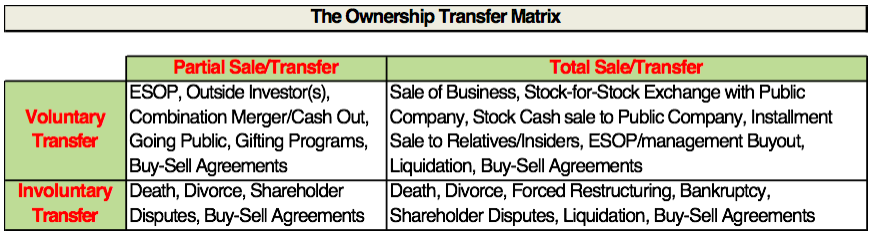

In the last month’s newsletter we discussed the need to keep good books and pricing strategies for your product or service and how this creates measurable value to your business. This month the focus is on developing “a” plan. I say “a” plan because plans change and no plan is fixed without the need to tweak and modify along the way. I am currently reading an excellent book written by the esteemed business appraiser Z. Chris Mercer, “Unlocking Private Company Wealth”. Below I am showing a pivotal table presented in his book that sets the stage for the future for closely held businesses.

In developing your business plan, where is the future of your business. The ownership transfer matrix shows the possible outcomes if you plan your company future (Voluntary Transfer) or don’t plan your company future (Involuntary Transfer). Each point within each cell shows possible outcomes for the company.

In the involuntary transfer box, the potential outcomes are not positive for the business owner without planning the future of the business. For example, if you die and you don’t have proper succession planning, your family may not have a business to rely on for their financial requirements. The same can be said regarding any of the other “involuntary transfer” events.

In the upper boxes the events shown are proactive events that are the result of early stage business planning. Do you notice that Buy-Sell Agreements are in each box? That is because Buy-Sell Agreements are that important. They are included in practically all Partnership agreements. Where did our counsel steer us wrong? Most practitioners involved in contracts or estate planning don’t realize the issues associated with a formula approach to business valuation. Would you sell your share of your business for book value? Maybe? Maybe not? I have seen Buy-Sell Agreements written as a multiple of earning? Is that a good idea? Again, maybe, maybe not. Some high tech businesses have “high” multiples of sales and don’t show a dollar of profits. (See salesforce.com) If you want to avoid the issues associated with the partnership disputes get a business appraisal when you start the partnership and nominate a qualified appraiser that the partners agree on to provide the per share price at seminal events or every year to provide shareholders the comfort of knowing their ownership of the company’s value.

If you would like to discuss any of these issues don’t hesitate to give me a call.

I hope you have a productive month.

Leave A Comment